Tax Considerations when paying yourself.

Sole Trader v Limited Company

Following on from my article ‘Sole Trader V Limited Company, this post focuses on the payment options for business owners operating in these two business models.

It specifically highlights why a limited company can offer tax advantages in the right scenario.

SALARY AND DIVIDEND

If you are a sole trader – you and the business are one therefore you pay income tax on the full business profits in line with the tax band rates:

2020/2021 INCOME TAX BANDS

| Band | Income |

| Personal allowance @0% | £0 – £12,500 |

| Basic rate @ 20% | £12,501 – £37,500 |

| Higher Rate @ 40% | above £37,500 |

If you are a director of a limited company, you can choose how to take money out of your business be it through salary, dividend, pension, share options etc.

The most common combination is likely to be a mixture of salary, dividend and were appropriate pension contributions. I would recommend a personal budgeting exercise to guide you I the amount you would need to take out. It is important to note when leaving fund in the business you need to be thinking about your plans for these funds and/or your exit strategy

Any salary taken will be taxed in line with the income rates above

Dividends can only be taken from company if it has made a profit and only after corporation tax has been paid on these profits. They are attractive as individuals have an annual tax free dividend allowance of £2,000 plus national insurance does not apply. Dividends above £2,000 are taxed in line with the rates below:

2020/2021 DIVIDEND TAX BANDS

| Band | Dividend | |

| Dividend Allowance | £0 – £2,000 | |

| Basic rate @ 7% | £12,501 – £37,500 | adjusted for what is used by salary |

| Higher Rate 32.5% | above £37,500 | adjusted for what is used by salary |

The flexibility of being able to chose what to take as income is a big advantage of the limited company business vehicle. However, this advantage only comes in to play when a business is making a profit above the higher rate tax bracket

Lets look at an example:

EXAMPLE 1

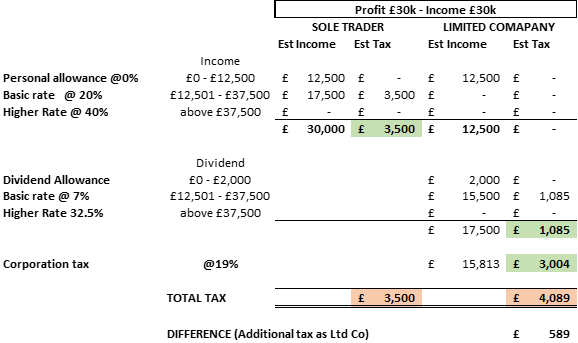

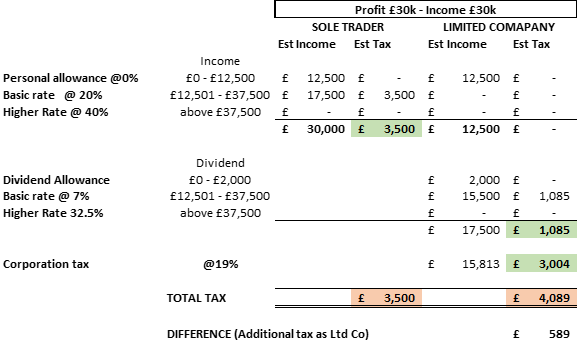

If we assume an individual requires income of £30k per annum

The below table shows how this would be taxed if they operated a business that made profits of £30k as a sole trader and as a limited company.

This example looks at the tax payable by both the individual director and that paid by the company.

As a Sole Trader all profits are taxable and the individual pays £3,500 in tax.

As a Limited Company the director can remove the funds they need in a combination of salary and dividend and as such pay a lower amount of income tax, £1,085.

Tax will however still be due on the company profits. Given the profit was £30k this will be reduced by the salary plus ERNI that was paid to the director. The revised profit figure is £15,813. Corporation tax is payable on this at 19% amounting to £3,004.

The total tax due under the limited company scenario is £4,089 – £589 higher than as a sole trader.

EXAMPLE 2

What is the business made £100k profit but the owner/director still only required £30k the calculations would look like this:

Here a sole trader would have no choice but to pay income tax on all the profits made by the business. Their tax liability would be £30k

As a limited company a director can chose to only take out the £30k they require and leave the remaining amount in the business. This can be extracted in the future as dividend or used to re-invest.

The individual would pay the same £1,085 as in the previous example.

Corporation tax on the profits less salary paid would be £16,304.

Taking all taxes together this results in a significant tax saving (£12,611).

The 2 examples illustrate how different business arrangements suit different businesses and it can be advantageous to plan and model out different scenarios and plan.

PENSION

Limited companies can also make pension contributions on behalf of its employees or directors. Pension rules are complex and specific advice would be needed but in general:

- An individual’s available pension allowance is £40,000 per tax year assuming they have a taxable income of £110,000 or less.

The £40,000 reduces if income is greater than this.

- If a company makes a pension contribution within the available pension allowance it is tax deductible for corporation tax.

- The individual will not be taxed on the contribution until they take it out of the pension fund and, under current rules, has the opportunity to draw out 25% of their pension fund completely free of tax (in most cases).

- Unused allowances from the previous three tax years may be available to be utilised.

- This can be a very tax efficient way of extracting funds from a limited company.

As a sole trader you can gain tax relief on payments into a pension, but these amounts are dependent upon your level of income. This can be quite restrictive and often does not offer the same advantages as being a director of a limited company.

TAX EFFICIENT BUSINESS PLANNING

As illustrated, a limited company can be tax efficient if the circumstances are right.

The tax benefit to a company is not the rates of tax at which salary and dividends are charged, but the fact that as a company owner it is possible to control when funds are extracted from the business and control the timing of the tax.

You may also be able to extract these funds to other family members who may be involved with the company.

It is important to use accurate information, plan early and seek advice when establishing the best methods of extracting funds.

A WORD OF WARNING

As most people know tax legislation and rules are not always straight forward.

If you are operating a limited company there are a few areas that you need to take caution with and avoid if necessary.

Some of these include:

- Be clear how you work for the company as a director. Certain work done will always be covered by PAYE and national Insurance

- IR35 rules should be considered given the legislation changes due to come into effect in 2021

- HMRC may challenge circumstances where they think dividends are being paid instead of a salary or where they see profits being shifted. This applies to scenarios where more than one director is present with varying degrees of involvement.

There may also be other tax consequences that should be considered. For example, inheritance tax or capital gains tax alongside the consequences of moving shares between family members or other people.

There is no one size fits all and to make the most of the tax advantages of a limited company and ensure things are administered correctly seek professional advice